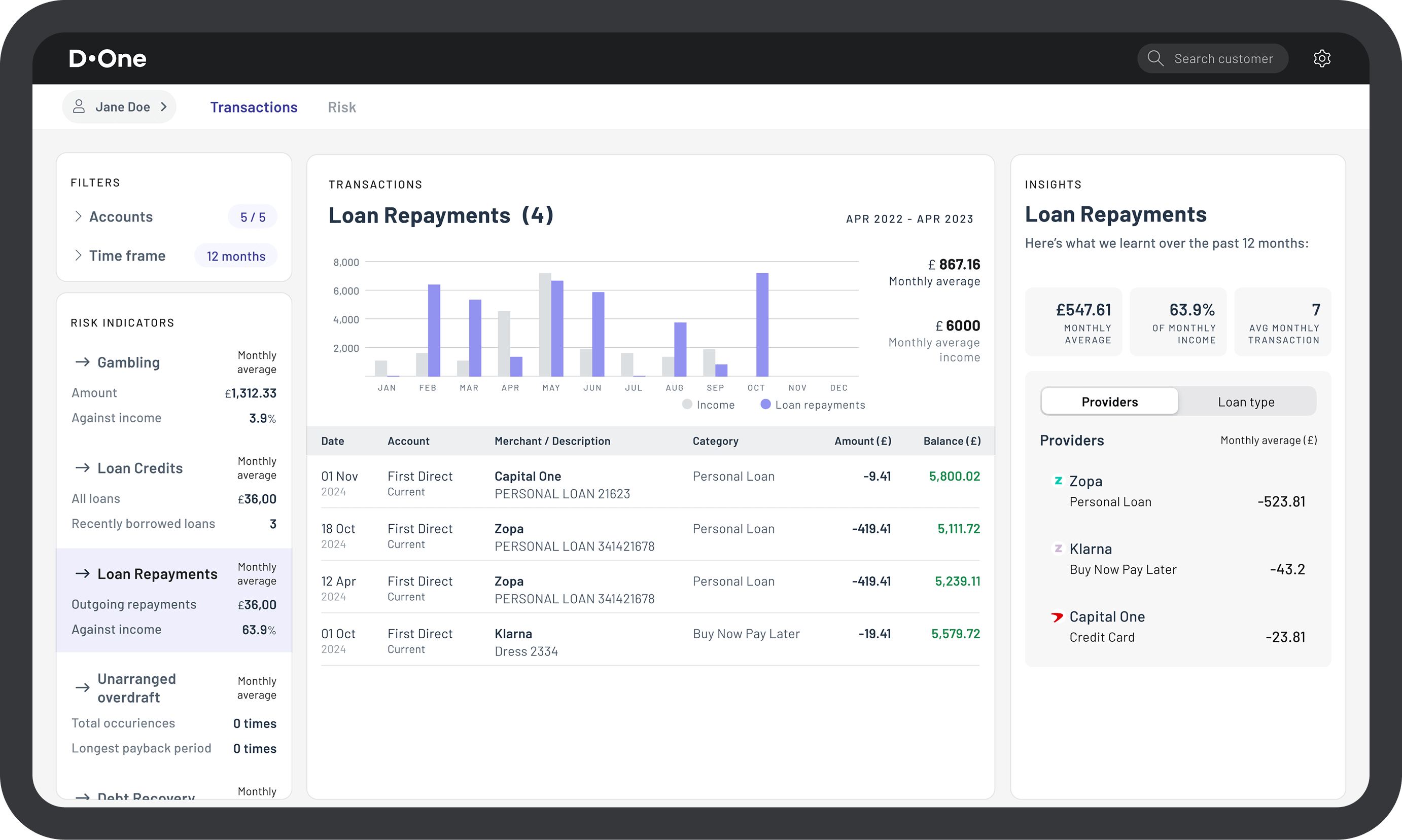

Open Banking insights - Underwriter Dashboard

Supporting informed underwriting decisions

Get a clear, organised view of your customers' transaction data through our underwriter dashboard, enabling informed lending decisions, faster approvals, cost savings, and visibility of at-risk customers.

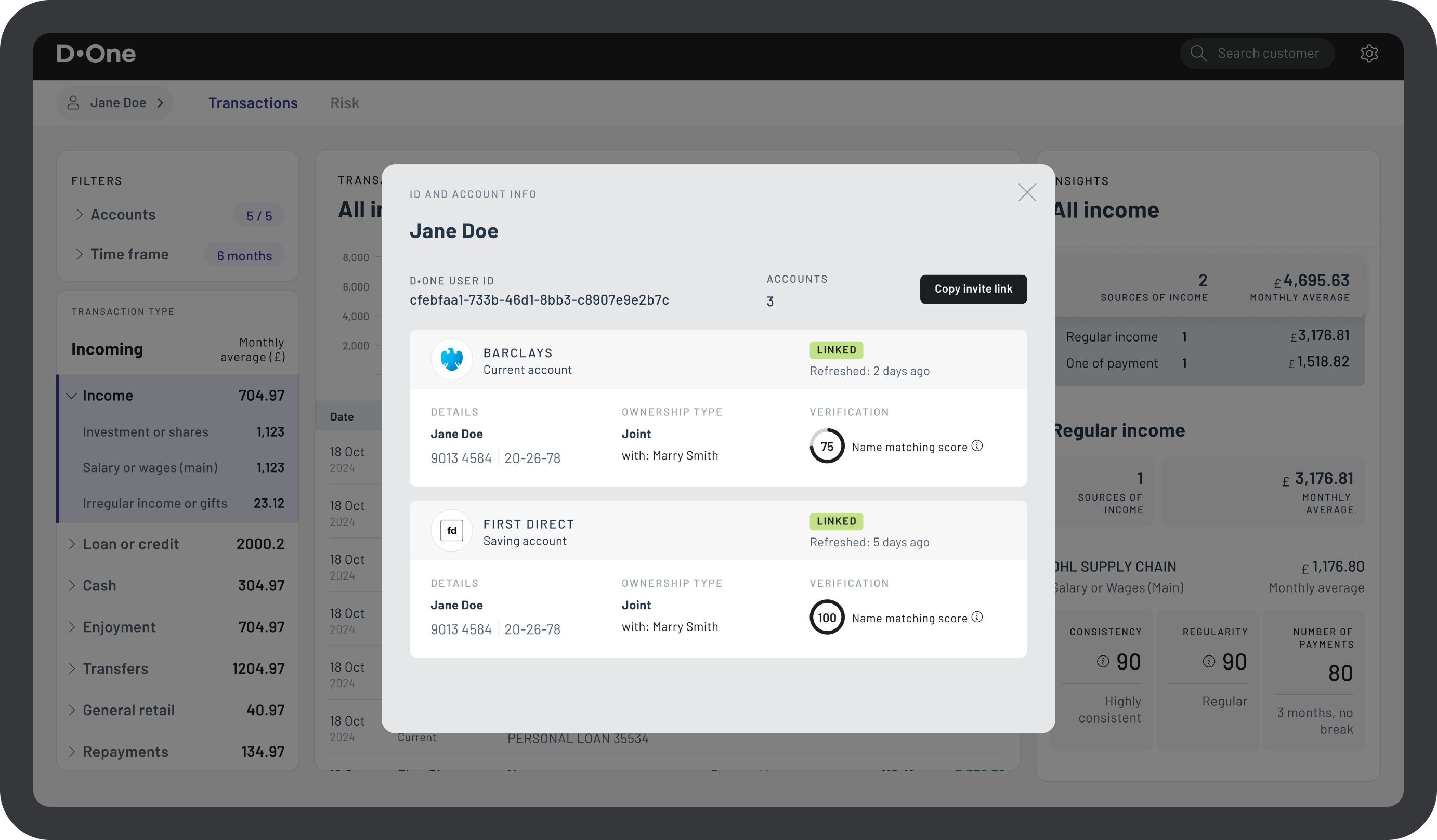

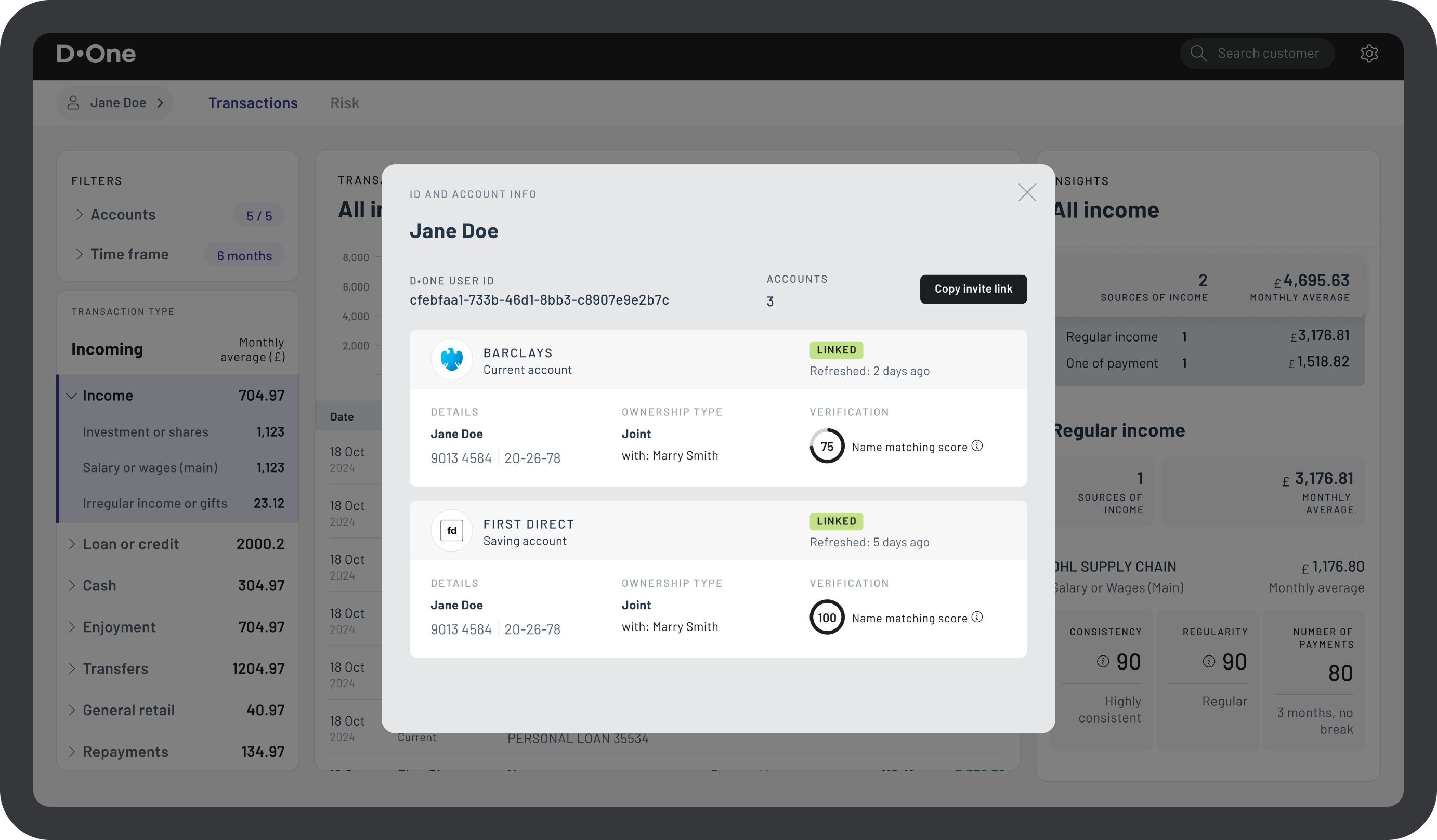

Account verification

Ensure the bank account belongs to the applicant by reviewing Data·One's identity match. Data·One provides a confidence score which can be used to ensure the bank account connected belongs to the individual. This is useful to combat fraud and to ensure disbursals are paid to the correct individual.

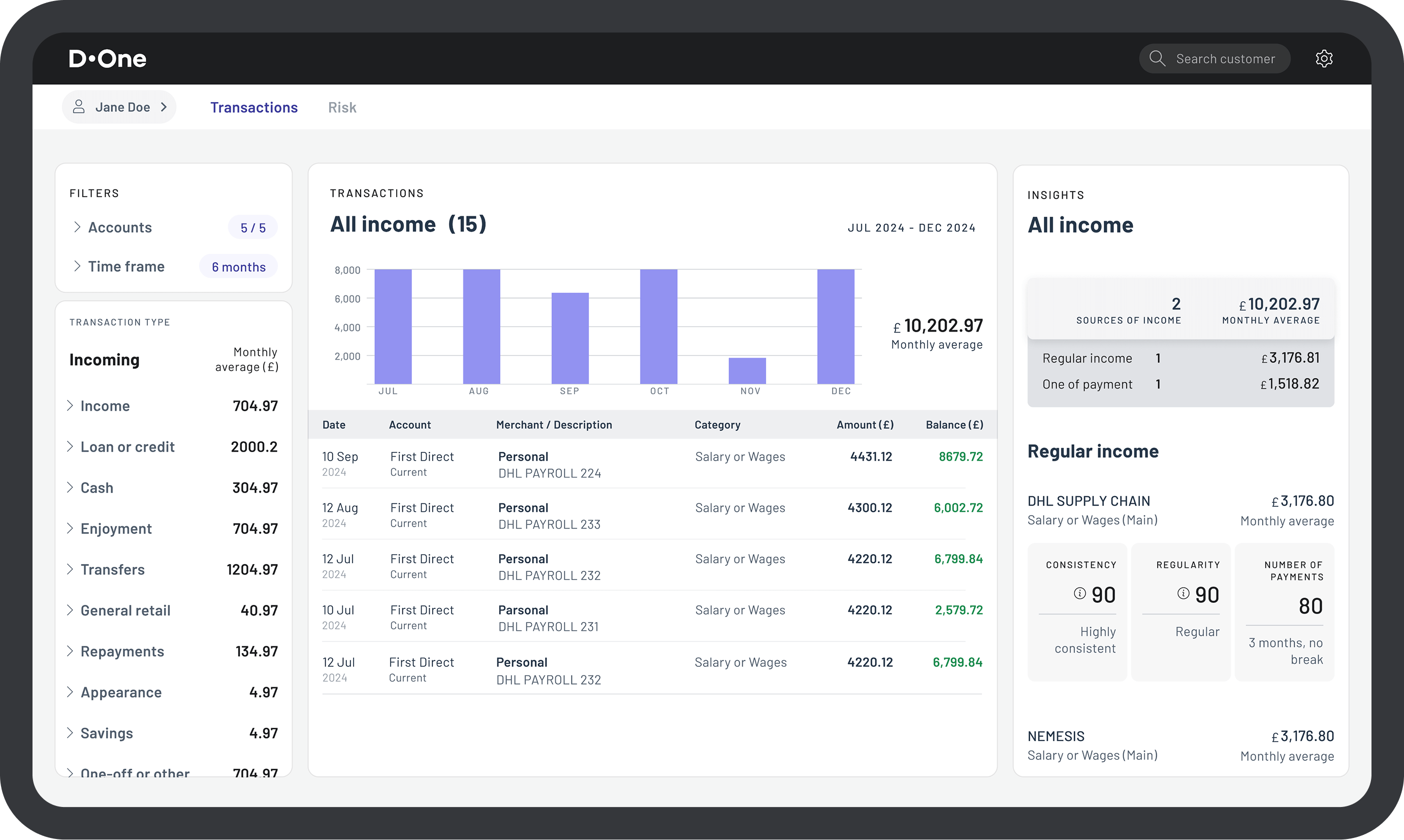

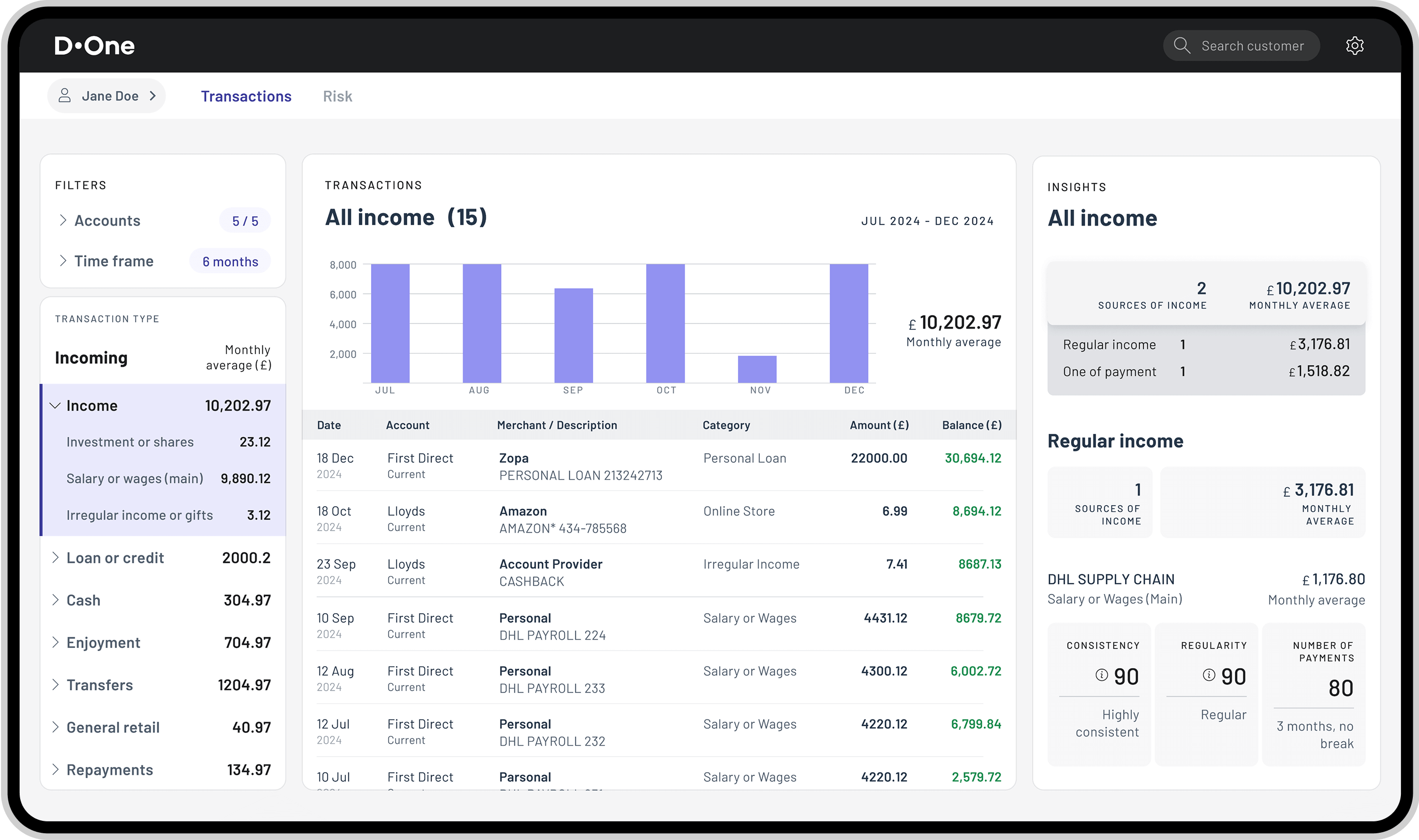

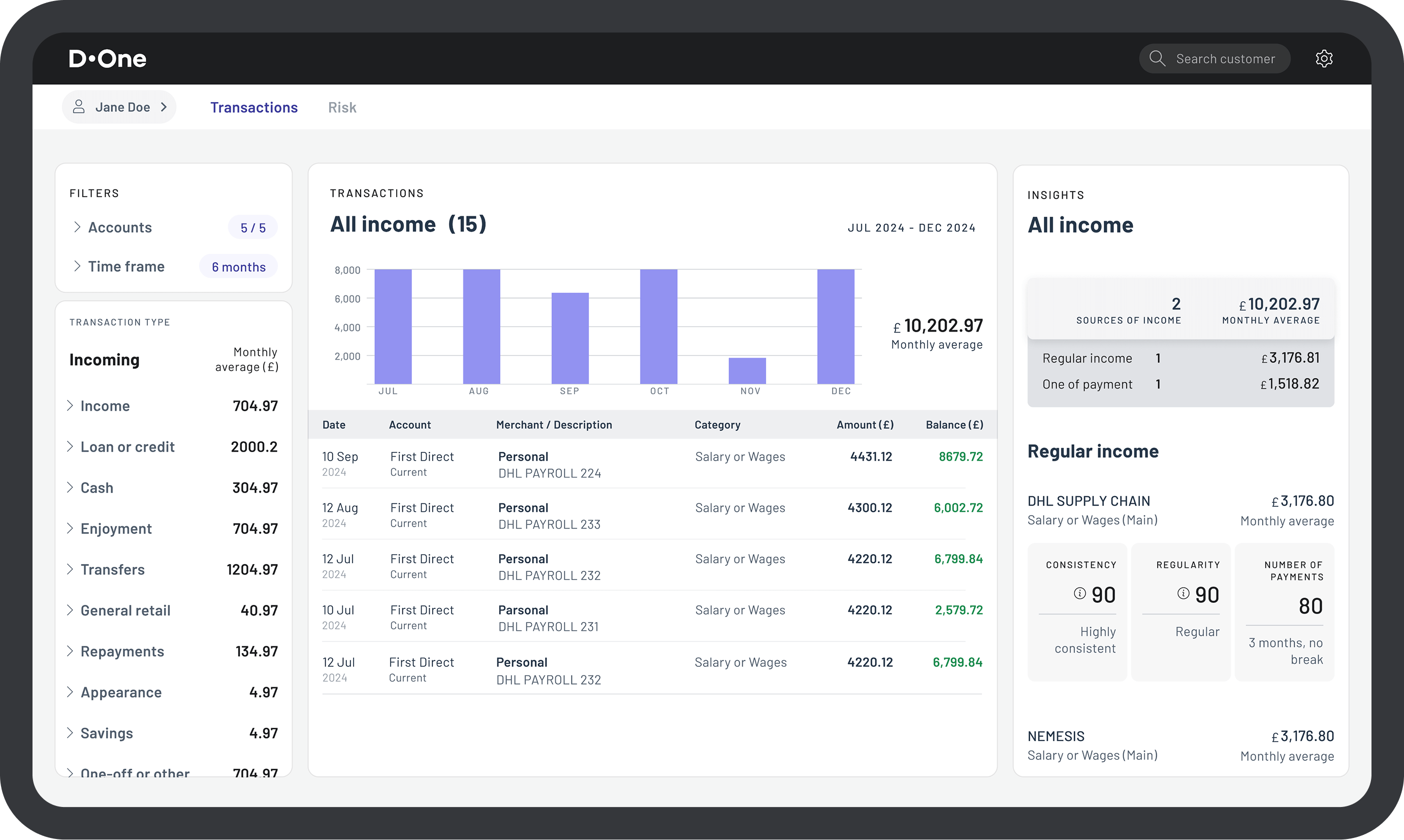

Income verification

Review variations in the applicants income across different time periods to assess the scale, stability and consistency of the income. This allows for income to be easily verified.

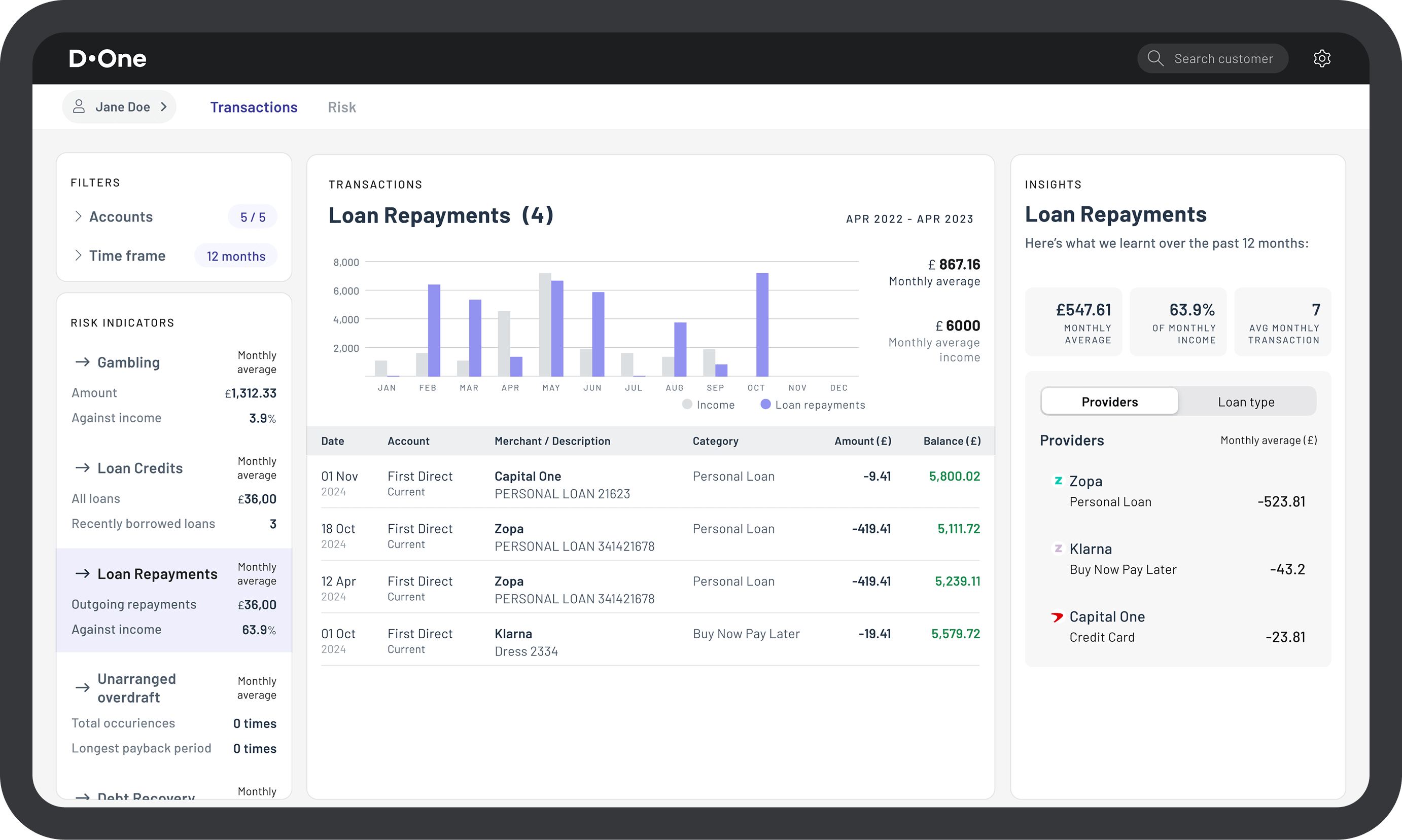

Risk insights

We display key risk factors such as gambling, loan repayments, and returned direct debits. In-depth analysis is displayed providing a deep understanding of the applicant's financial behaviour allowing the credit application to be approved or rejected.

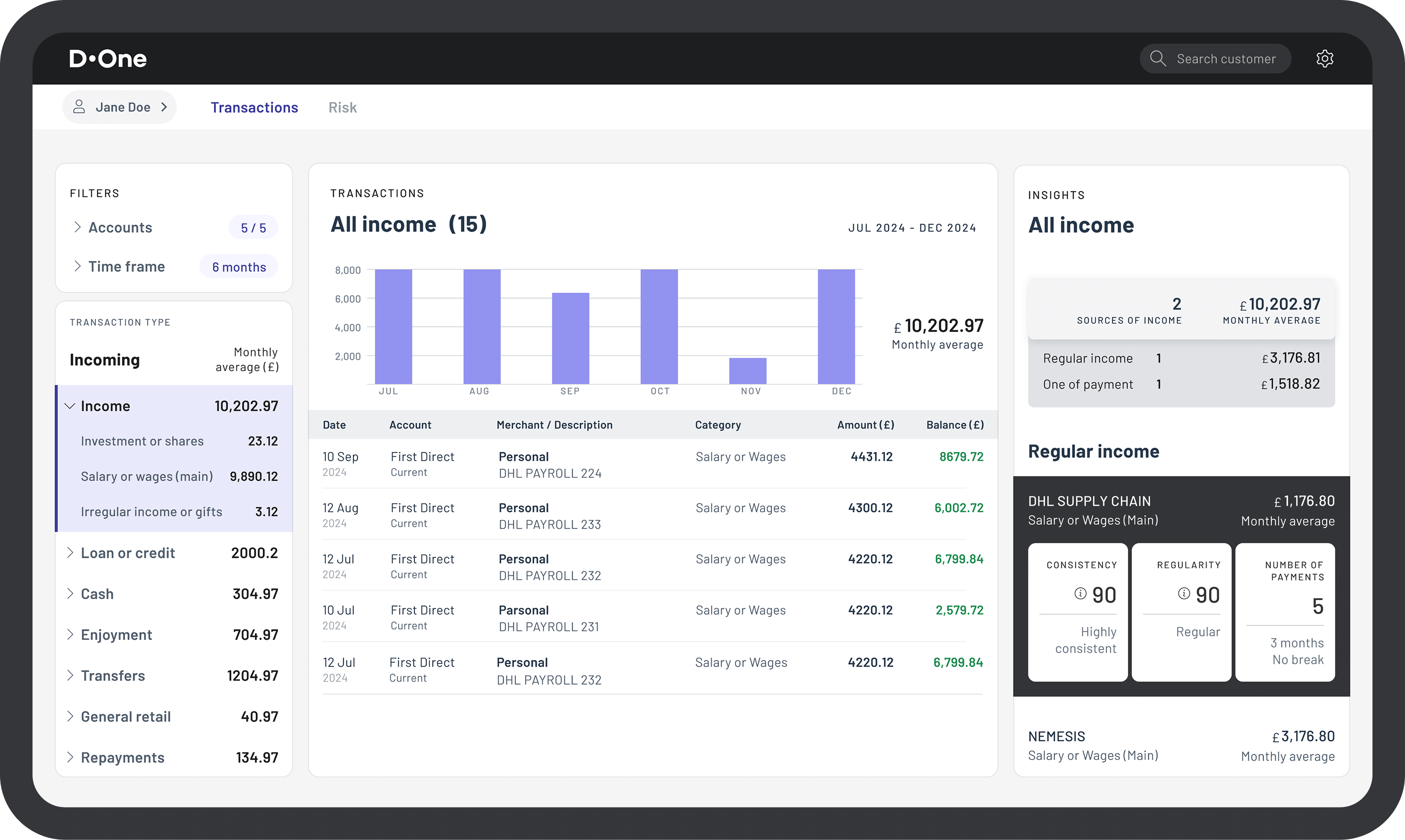

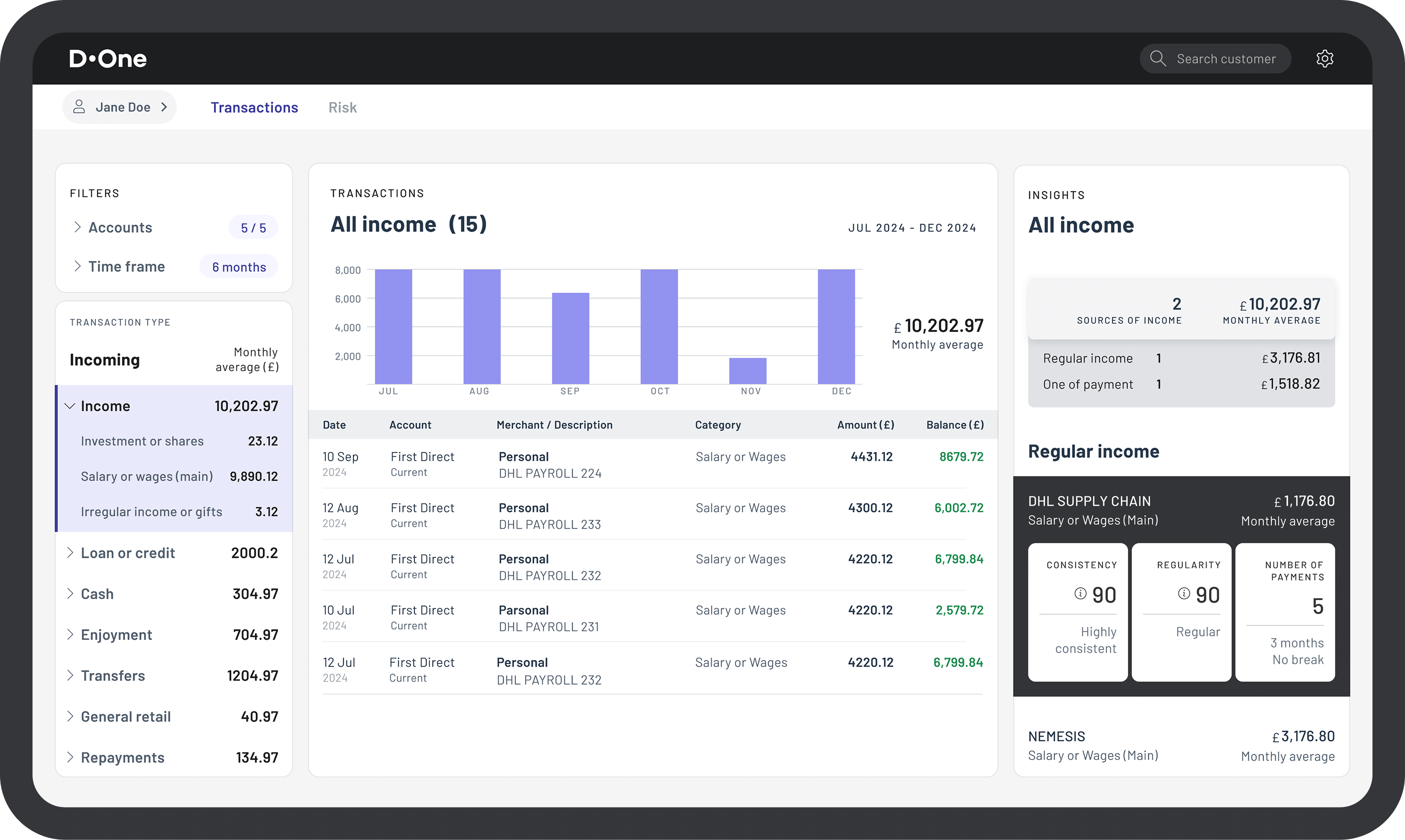

Affordability assessment

Perform an affordability assessment by reviewing the bank transactions of the applicant. These are displayed to make affordability assessments quick and accurate. No longer do you need to rely on demographic averages.